Who We Are

We are a local agency, we know the market here in Utah and can keep you compliant with the National ACA rules while keeping you covered with the plans that best suit your business. |

This ever changing world of health care can be confusing and frustrating. We prefer to sit down with you to find your particular needs and begin to customize a plan to suit your company's needs. The Patient Protection and Affordable Care Act (PPACA) is here and is a challenge to every employer big or small. We can take the burden of knowing all the changes and challenges away and let you focus on your business and employees. Contact us for a no cost consultation, let us show you how we can help benefit you and your business.

We offer a wide array of product to our clients including:

|

HSA Contributions limits for 2021

Family $7,200

Individual $3,600

Catch-Up (55 years of age or older) $1,000

Family $7,200

Individual $3,600

Catch-Up (55 years of age or older) $1,000

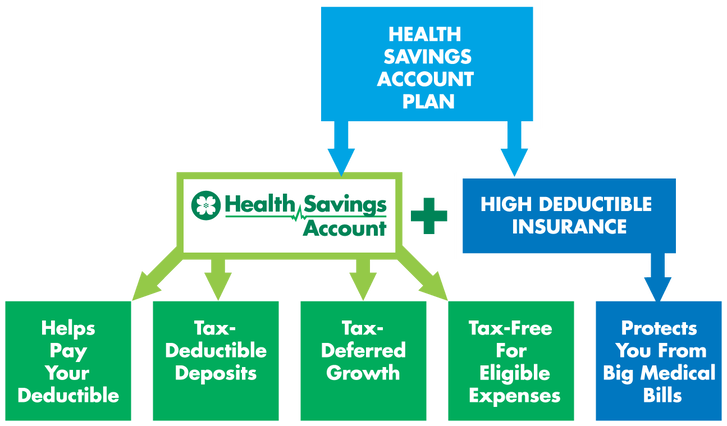

What is an HSA?

Simply stated, an HSA is what you get when you combine a high-deductible health insurance plan and a tax-exempt savings account. They are designed to allow individuals to use pre-tax dollars to help pay for current and future medical expenses.

What Are the Benefits of an HSA?

How Does It Work?

HSA.s work just like a normal checking account – contributions are as easy as making a deposit and paying eligible expenses are as easy as writing a check or using your debit card.

Why High Deductible Insurance?

To get the benefits of an HSA, the law requires that the savings account be combined with a high deductible health insurance plan.

Contributing to an Health Savings Account

Contributing to an HSA is easy – and it comes with some great tax advantages.

Who Can Contribute?

Tax Advantages:

Contributions Are:

Spending Your HSA

HSA funds are payable on demand. There are no restrictions on when or how you may take distributions. However, to fully recognize the tax advantages, funds must be used for qualified medical expenses.

The IRS requires that an HSA be an individual account. If you would like another person to have a debit card, you may name them as an authorized signer.

What Happens to Unused HSA Funds?

What Happen When I Reach Age 65?

As of age 65, funds can continue to be used for eligible medical expenses tax-free. You may also use the funds for non-eligible expenses and you are only subject to ordinary income tax without any IRS penalty.

What Are the Benefits of an HSA?

- Contributions are 100% tax deductible

- You choose when to make your contributions and how to invest them

- Contributions to your HSA by your employer are excluded from your gross income

- Unused funds rollover from year to year

- The interest or other earnings on the assets in the account are tax deferred

- Funds can be used at any time for qualified medical expenses tax-free

How Does It Work?

HSA.s work just like a normal checking account – contributions are as easy as making a deposit and paying eligible expenses are as easy as writing a check or using your debit card.

Why High Deductible Insurance?

To get the benefits of an HSA, the law requires that the savings account be combined with a high deductible health insurance plan.

Contributing to an Health Savings Account

Contributing to an HSA is easy – and it comes with some great tax advantages.

Who Can Contribute?

- Employers and employees can contribute to an HSA as long as the account holder meets the requirements for HSA eligibility

- Family members or any other person can make contributions on behalf of an eligible individual

Tax Advantages:

- Contributions are 100% tax-deductible for the account holder (excluding employer contributions)

- Funds grow on a tax-deferred basis and if the funds are used for an eligible expense, the funds are tax-free

- Funds rollover from year to year

- After age 65, funds can be used tax-free for eligible expenses, including Medicare premiums, or taxed with no penalty for other expenses

Contributions Are:

- 100% tax-deductible for the account holder (excluding employer contributions)

- Owned by account holder until the funds are used

- Made at any point during the year, up to the individual's tax deadline (usually April 15, just like IRAs)

Spending Your HSA

HSA funds are payable on demand. There are no restrictions on when or how you may take distributions. However, to fully recognize the tax advantages, funds must be used for qualified medical expenses.

The IRS requires that an HSA be an individual account. If you would like another person to have a debit card, you may name them as an authorized signer.

What Happens to Unused HSA Funds?

- No use it or lose it rules

- All amounts in the HSA are fully vested

- Unspent balances in accounts remain in the account until spent

- Accounts can grow through investment earnings, just like an IRA

- Same investment options and investment limitations as an IRA

- Same restrictions on self-dealing as with IRAs

What Happen When I Reach Age 65?

As of age 65, funds can continue to be used for eligible medical expenses tax-free. You may also use the funds for non-eligible expenses and you are only subject to ordinary income tax without any IRS penalty.

We want to help you and your employees understand your benefits and how they apply. Employee workshops can help your employees understand their benefits. Let us know if you would like to schedule a workshop.

|

Large or small we have the team to help you. Please contact us for a quote or visit.

|